social security tax limit 2021

If that total is more than 32000 then part of their Social Security may be taxable. For 2021 the FICA tax rate for employers is 76562 for OASDI and 145 for HI the same as in 2020.

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Under federal law people who are receiving social security.

. Twelve states also tax Social Security benefits as income. How is Social Security taxed 2021. Filing single single head of household.

Only the social security tax has a wage base limit. The Medicare portion HI is 145 on all earnings. Social Security Tax Limit Example 2021 Income.

The Social Security tax rate for those who are self-employed is the full 124. As a result the Trustees project that the ratio of 27 workers paying Social Security taxes to each person collecting benefits in 2020 will fall to 22 to 1 in 2039. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Also as of January 2013 individuals with earned income of more than in Medicare taxes. D Tax-exempt interest plus any exclusions from income. Or Publication 51 for agricultural employers.

The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. B One-half of amount on line A. Under federal law people who are receiving Social Security benefits and who have.

The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. If you have a traditional job you pay 62 of your salary per year in Social Security taxes. Social Security recipients will also receive a slightly higher benefit payment in 2021.

The Social Security taxable maximum is 142800 in 2021. 145 Medicare tax on the first 200000 of wages 250000 for joint returns. For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

0 if youre married filing separately and lived with your spouse at any time during the tax year. What is the maximum taxable earnings each year. SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple.

Fifty percent of a taxpayers benefits may be taxable if they are. This amount is also commonly referred to as the taxable maximum. That number is then matched by your employer.

When you have more than one job in a year each of your employers must withhold Social Security taxes from your wages. A Amount of Social Security or Railroad Retirement Benefits. Employeeemployer each Self-employed Can be offset by income tax provisions.

If you earn more than 25000 as a single filer or 32000 as a joint filer up to 85 of your Social Security benefits are fair game to the IRS. If an employees 2021 wages salaries etc. But theres a cap on how much money people are expected to contribute every year.

The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below. You might be interested. This is the maximum amount of social security tax an employee will have withheld from their paycheck.

In 2021 you will pay Social Security taxes on. The wage base limit is the maximum wage thats subject to the tax for that year. There is a limit on the amount of annual wages or earned income subject to taxation called a tax cap.

If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. This means that you will not be required to pay any additional Social Security taxes beyond this amount. In 2010 tax and.

This is the largest increase in a decade and could mean a higher tax bill for some high earners. For 2021 an employee will pay. You Can Lose Some of Your Benefits to Taxes.

Thus an individual with wages equal to or larger than 147000. Social Security and Medicare taxes. Filing single head of household or qualifying widow or widower with 25000 to 34000 income.

Worksheet to Determine if Benefits May Be Taxable. The Social Security tax limit in 2021 is 885360. Workers pay a 62 Social Security tax on their earnings until they reach 142800 in earnings for the year.

Fifty percent of a taxpayers benefits may be taxable if they are. This could result in a higher tax bill for some taxpayers. Wage Base Limits.

What is the Social Security cap for 2021. For earnings in 2022 this base is 147000. 62 of each employees first 142800 of wages salaries etc.

Exceed 142800 the amount in excess of 142800 is not subject to the Social. The tax rates. The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher.

Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. The maximum earnings that are taxed have changed over the years as shown in the chart below.

If youre married and file a. How Much You Will Get From Social Security. In 2022 the Social Security tax limit increased significantly to 147000.

If your combined income was. Your employer would contribute an additional 885320 per. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

The maximum taxable amount for the Social Security tax is 142800 in 2021. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. For earnings in 2022 this base is 147000. We call this annual limit the contribution and benefit base.

The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

The 765 tax rate is the combined rate for Social Security and Medicare. Maximum Taxable Earnings Each Year Year Amount 2018 128400 2019 132900 2020 137700 2021 142800. How much will my Social Security tax be if Im married.

C Taxable pensions wages interest dividends and other. The wage base limit is the maximum wage thats subject to the tax for that year. If that total is more than 32000 then part of their Social Security may be taxable.

In 2022 the social security tax rate is 62 for employers and employees unchanged from 2021. Married filing separately and lived apart from their spouse for all of 2021 with more than. If you earned more than the maximum in any year whether in one job or more than one we only use the maximum to calculate your benefits.

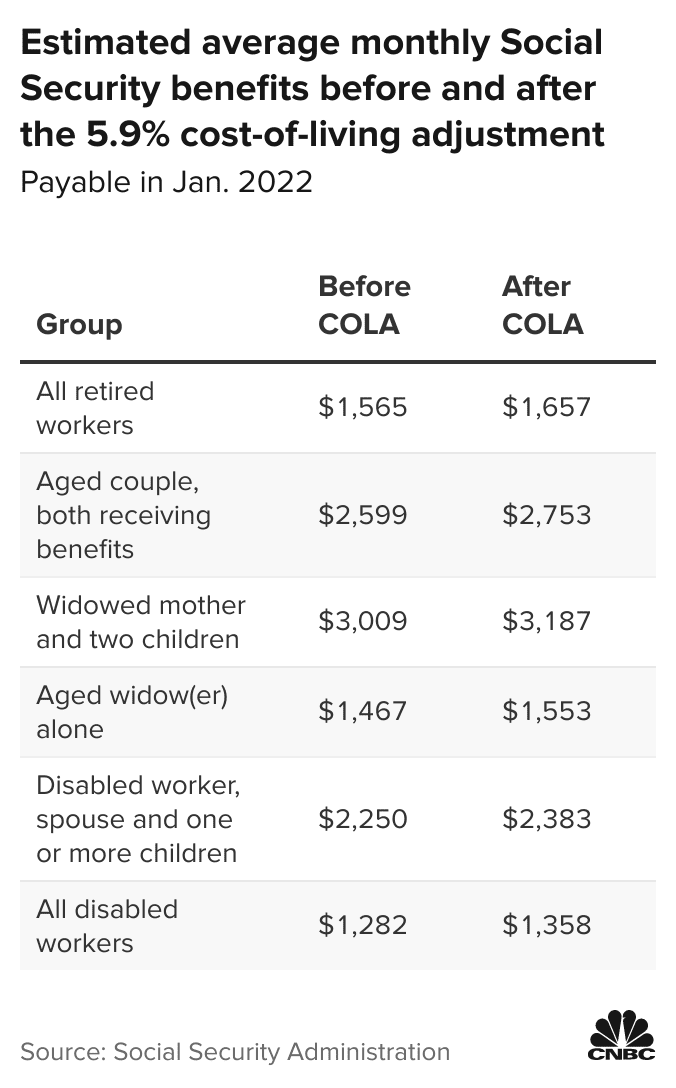

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Social Security recipients will get a 59 raise for 2022 compared with the 13 hike that beneficiaries received in 2021. Which of the.

In 2021 the maximum amount of income subject to the Social Security tax is 142800. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. The maximum amount of Social Security tax an employee will pay in 2021 is 885360.

In 2022 the maximum is 147000. Information for people who receive Social Security benefits.

2 753 Monthly Check What Are The Requirements To Apply In Case Of Approval As Usa

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Understanding Your W 2 Controller S Office

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

2021 Social Security Earnings Limit Youtube Social Security Social Financial Decisions

Will Bernie Sanders Social Security Expansion Act Save Social Security Or Wholly Upend The System

All The States That Don T Tax Social Security Gobankingrates

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

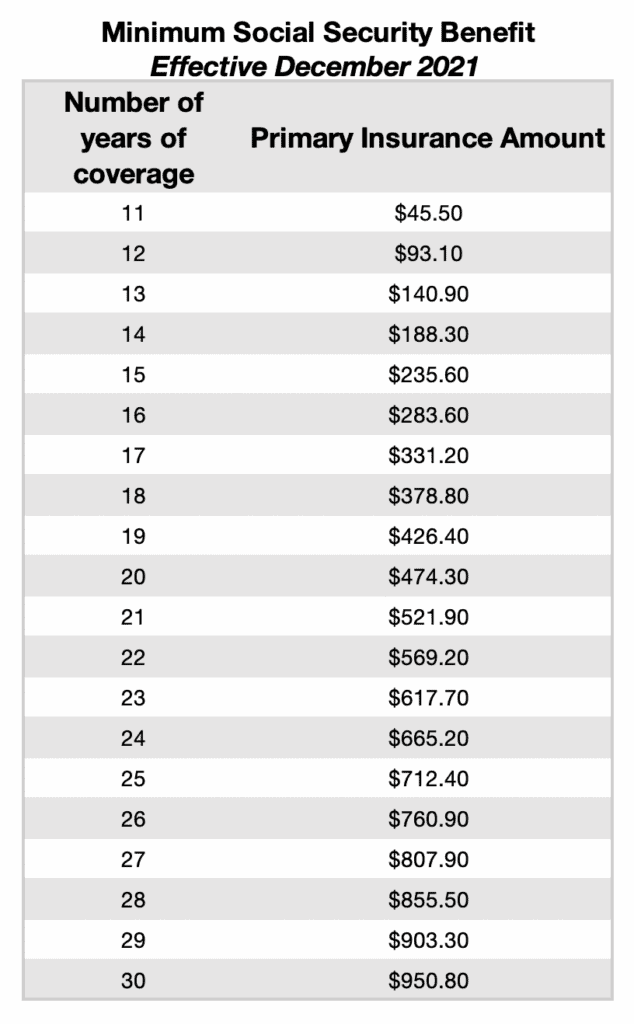

What Is The Minimum Social Security Benefit Social Security Intelligence

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

What Is The Social Security Tax Limit Social Security Us News

Social Security Types Payouts The Program S Future

At What Age Is Social Security No Longer Taxed In The Us As Usa

Finding Solutions Retirement And Social Security

Social Security Wage Base Increases To 142 800 For 2021

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)